How to Improve Your Credit Score in 90 Days

Just as I found myself needing a better credit score, you might be in a similar situation. In this guide, I will share effective strategies that can help you boost your credit score in just 90 days. With some dedication and the right tactics, you can open doors to better loan rates and financial opportunities. Let’s look into the steps you can take to elevate your creditworthiness and achieve your financial goals.

Key Takeaways:

- Check your credit report for any inaccuracies and dispute them promptly.

- Pay your bills on time, as timely payments significantly impact your credit score.

- Reduce outstanding debt by prioritizing high-interest accounts and making regular payments.

- Avoid opening new credit accounts during this period to prevent unnecessary hard inquiries.

- Consider becoming an authorized user on an account with a positive payment history to improve your credit utilization ratio.

The Foundation of Your Credit Score

Understanding the fundamental components that contribute to your credit score is important for any strategy aimed at improving it. Your credit score is importantly a number that reflects your creditworthiness, and it’s based on your credit history. This score is not just a simple calculation; it is derived from various factors that examine your financial behavior. Knowing these elements allows you to make informed decisions and strategically enhance your credit profile.

The Five Key Factors Influencing Your Score

Five primary factors dictate your credit score, and their influence is not equal. Here’s a breakdown of each factor and their weight in the scoring model:

- Payment History (35%): Your track record of on-time payments significantly impacts your score.

- Credit Utilization (30%): The ratio of your current credit card balances to your credit limits is a crucial consideration.

- Length of Credit History (15%): A longer credit history can enhance your score, provided it reflects responsible credit use.

- Types of Credit (10%): A mix of credit types (credit cards, mortgages, installments) can positively affect your score.

- New Credit Inquiries (10%): Frequent applications for new credit can hurt your score.

Assume that if you focus on these five areas, you can make tangible improvements to your credit score over time.

Debunking Common Credit Score Myths

Numerous misconceptions surround credit scores, which can mislead individuals into making poor financial decisions. For instance, a common myth is that checking your own credit score will lower it—this is untrue. When you check your own credit, it’s classed as a soft inquiry and does not affect your score. Another widespread belief is that closing an old credit card will improve your credit score. In reality, this action can negatively impact your length of credit history and increase your overall credit utilization ratio, ultimately harming your score.

Many people also think that having a credit score below a certain threshold forever disqualifies them from better interest rates or loans. My personal experience shows that with a consistent, strategic approach to managing credit, you can gradually rebuild your score over time. Misunderstandings surrounding these topics often lead to unnecessary stress and inaction; arming yourself with accurate information can help you make empowered decisions with your finances.

Strategies for Quick Wins

Paying Down Debt: Prioritizing High-Interest Accounts

Focusing on high-interest debt can significantly improve your credit score in a short period. I recommend starting with credit cards or loans that carry the highest interest rates first. These accounts not only accumulate more debt rapidly but also affect your credit utilization ratio—the total amount of credit you’re using compared to your total available credit. Start by allocating any extra funds you may have towards these high-interest debts. If you can make even small payments above the minimum, you’ll be reducing overall utilization and saving money on interest in the long run.

Consider using the snowball method, where you pay off the smallest debt first while making minimum payments on the larger debts. Once the smallest debt is cleared, you move to the next one. This method can generate quick wins, which may bolster your motivation as you can see financial progress more immediately. By reducing the balance on your cards, you lower your credit utilization percentage, which can enhance your score significantly.

Correcting Inaccuracies: The Power of Credit Reports

Discrepancies in your credit report can lower your score, so taking the time to review your report is a smart move. I recommend checking your credit report for errors, such as incorrect balances, late payments that should be marked as current, or even accounts that don’t belong to you. Every year, you are entitled to a free copy of your credit report from each of the three major credit bureaus. Scrutinize them closely to spot and dispute inaccuracies; these errors, if fixed, can lead to an automatic improvement in your credit score.

Once inaccuracies are identified, you can dispute them directly with the credit bureaus. The process typically involves writing a letter explaining the error, attaching relevant documents that support your claim. According to the Fair Credit Reporting Act, the bureaus must investigate the dispute, usually within 30 days. The statute of limitations for responding means that you can expect timely rectification in many cases, ensuring your score reflects your true financial behavior. A clean report will not only improve your score but also make you more attractive to lenders.

Leveraging Financial Tools to Boost Your Score

Using Secured Credit Cards Effectively

Secured credit cards serve as an excellent tool in rebuilding or increasing your credit score. By depositing a cash amount as collateral, often similar to your credit limit, these cards allow you to borrow against that deposit while easily managing your spending. The key is to treat it like a regular credit card; make timely payments and keep your balances low. The utilization rate—staying below 30% of your available credit—plays a significant role in your credit score calculation, so aim to charge a small amount each month and pay it off in full to show responsible credit usage.

Your payment history will also reflect positively on your credit report, which counts for 35% of your score. If you consistently make on-time payments, the secured credit card can help transition you back into the world of unsecured credit options. Many secured cards also allow you to upgrade to an unsecured card after a period of responsible usage, further enhancing your credit standing while giving you access to added benefits.

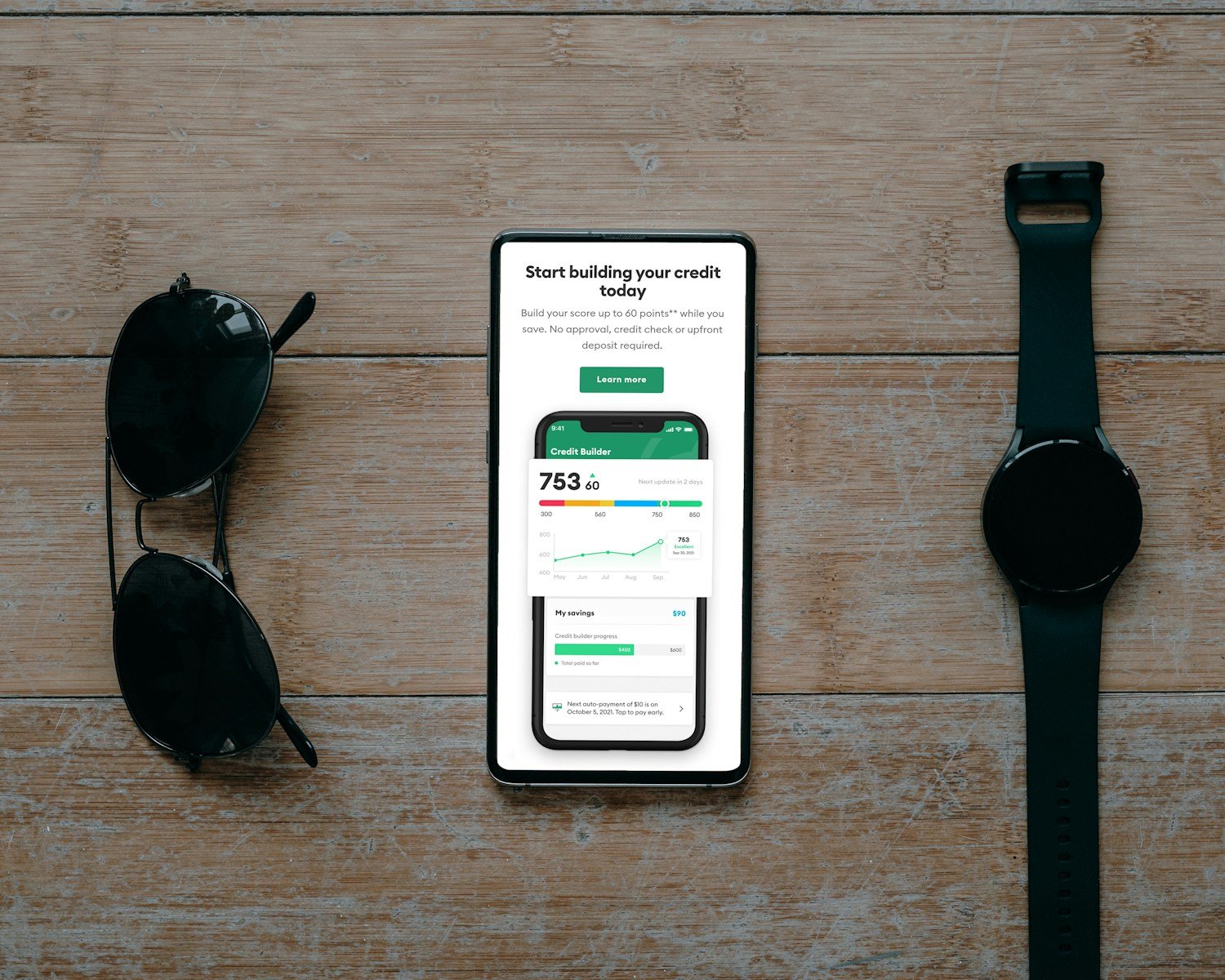

The Role of Credit Builder Loans in Score Improvement

Credit builder loans serve as a powerful tool for anyone looking to improve their credit score in a relatively short time frame. Typically offered by credit unions or community banks, these loans allow you to borrow a small amount of money that is held in a savings account, and you make monthly payments towards the loan until it’s paid off. Since the lender reports your payment history to the credit bureaus, each payment made contributes positively to your credit score, showcasing your reliability as a borrower. This is particularly beneficial for those who may not yet have an extensive credit history.

Through regular monthly payments, you create a consistent payment history, which is imperative for building a solid credit score. I often suggest that my clients consider these loans as an investment in their financial future. The funds you pay into the loan are released to you once it’s fully paid off, meaning you’re not just building credit—you’re also saving money in the process. This dual benefit can make credit builder loans a wise choice for anyone serious about improving their credit health.

Building Positive Credit Habits for Longevity

Establishing a Consistent Payment Routine

Creating a payment routine is one of the simplest and most effective ways to establish positive credit habits. I set up reminders on my phone for due dates or use apps that help track bills, so I never miss a payment. Automation is another strategy I use where I opt for automatic payments on my credit cards and loans. This ensures I pay at least the minimum amount on time, avoiding potential late fees and damage to my credit score. Keep an eye on your statement, however, to ensure you don’t accidentally overspend, leading to further issues.

Staying organized and consistent is vital. For example, I committed to checking my credit card balances weekly, which helps me stay on top of what I owe and prevents surprises. It also reinforces the habit of making timely payments, ultimately improving my credit history. Regularly reviewing my payment history not only boosts my credit score but also gives me confidence in handling my finances responsibly.

Maintaining Low Credit Utilization Ratios

Keeping your credit utilization ratio low is another strategy that has significant longevity in maintaining a healthy credit score. Ideally, I aim to use less than 30% of my available credit. If my total credit limit is $10,000, I ensure my total balance across all cards does not exceed $3,000. This ratio demonstrates to lenders that I am not overly reliant on credit, which can be a red flag. I also make a habit of paying down balances before the billing cycle closes, further improving my utilization ratio and boosting my score.

This concept ties directly to overall financial health. A habit of maintaining low credit utilization aligns with sound budgeting practices, ensuring I do not spend beyond my means. For instance, if you have multiple cards but can only afford to charge low amounts, consider spreading out your purchases to keep utilization ratios low across all accounts. This allows me to maintain a strong standing with creditors while managing my finances prudently.

Consider reviewing your credit report regularly to monitor utilization ratios. I utilize free credit monitoring services to keep an eye on my balances and to evaluate when I might need to adjust my spending. This proactive approach allows me to make informed decisions and prevent unforeseen dips in my credit score, ultimately leading to more favorable loan terms in the future.

Monitoring Your Progress: Tools and Techniques

Setting Up Alerts for Important Credit Activities

To stay on top of your credit score improvement journey, I recommend setting up alerts for significant credit activities. This proactive approach allows you to get real-time updates regarding changes in your credit report, such as new inquiries or changes in your account balances. Many credit monitoring services offer customizable alerts, which can notify you via email or text when unusual activity occurs. This way, you can quickly address potential issues before they impact your credit score. For instance, if a creditor misses a payment on your account, receiving an alert ensures that you can follow up immediately to clarify discrepancies.

Moreover, regular alerts can also help you celebrate your progress. When your credit score improves, or when an outstanding debt is paid off, I find that receiving a notification can motivate you to continue practicing good credit habits. I often check the settings on my credit monitoring apps to make sure I’m receiving alerts on activities that are most relevant to my financial goals. Tailoring these notifications can also highlight patterns that reveal where you’ve made significant strides and where additional effort may be needed.

Regularly Reviewing Your Credit Report for Improvements

Frequent review of your credit report is an invaluable technique in my toolkit. By obtaining a free report from each of the three major credit bureaus annually, I can keep tabs on my credit history and identify areas for improvement. I make it a habit to thoroughly read through all sections of my report, checking for inaccuracies or outdated information that could negatively affect my score. If I find errors, I reach out to the credit bureau to dispute them, which can sometimes lead to immediate increases in my score.

The act of tracking my progress against previous reports is key to understanding how my credit improvement strategies are paying off. You can look for signs of positive financial behavior, such as decreased utilization rates or increased credit length, which indicate that efforts like timely payments or reducing debt are making a difference. Utilizing resources like How to Improve Your Credit Score in 90 Days can provide further insight into nuances in my credit report and illuminate additional steps I can take.

By consistently reviewing my credit report, I not only become more informed about my financial standing but also empower myself to make better credit decisions in the future, knowing what has worked and what has not.

Final Words

With these considerations, I believe that taking proactive steps to improve your credit score in just 90 days is entirely achievable. By diligently reviewing your credit report, disputing inaccuracies, and making timely payments, you can create a significant positive impact on your credit profile. Additionally, lowering your credit utilization and considering becoming an authorized user on a responsible person’s account can further enhance your score. It’s about prioritizing your financial health and making informed decisions that align with your long-term goals.

Ultimately, I encourage you to stay committed to the process and monitor your progress regularly. Utilizing tools like credit-monitoring services can also help you track improvements and alert you to any changes. I understand that improving your credit score requires discipline and patience, but with a focused approach, you will see tangible results that will empower you to achieve your financial aspirations. Your credit score is a powerful tool that opens doors to better lending options, and taking these steps will set you on the right path.

FAQ

Q: What are the first steps I should take to improve my credit score?

A: Start by obtaining your credit report from all three major credit bureaus: Experian, Equifax, and TransUnion. Review your report carefully for any errors or inaccuracies that may be negatively affecting your score. If you find mistakes, dispute them immediately. Next, focus on paying down existing debts, especially those that are nearing their limits. Lowering your credit utilization ratio can have a significant impact on your score.

Q: How does paying bills on time affect my credit score?

A: Timely bill payments are one of the most significant factors influencing your credit score, accounting for about 35% of the total score calculation. Establishing a pattern of on-time payments can improve your score over time. Setting up automatic payments or reminders can help ensure you don’t miss due dates.

Q: Is it beneficial to keep old credit accounts open?

A: Yes, maintaining older credit accounts can positively impact your credit score. Length of credit history makes up about 15% of your score, so keeping older accounts open, even if they are not frequently used, can help enhance your credit profile. Just be sure to avoid inactivity fees and keep the accounts in good standing by making occasional small purchases.

Q: Should I try to open new credit accounts to improve my score?

A: Opening new credit accounts can have a mix of effects on your credit score. While having different types of credit (credit cards, installment loans) can benefit your score, applying for multiple accounts in a short time can result in hard inquiries, which may temporarily lower your score. Instead of immediately opening new accounts, consider focusing on improving existing credit and building a solid payment history.

Q: How often should I check my credit score during the 90-day improvement plan?

A: It can be helpful to check your credit score regularly, ideally once a month, during your 90-day improvement plan. This will allow you to monitor your progress and make adjustments as needed. There are various free resources available online where you can check your score without impacting it. Tracking your score will keep you motivated and informed about how your credit habits are affecting your financial standing.