How To Pay Credit Card Bill To Increase Credit Score

You want to boost your credit score, and paying your credit card bill on time is a fantastic way to do it! In this guide, I’ll walk you through some simple steps that can help you manage your payments effectively and enhance your credit profile. With just a little effort, you can set yourself up for financial success and enjoy the benefits of a better credit score. Let’s dive right in!

Key Takeaways:

- Pay your credit card bill in full each month to avoid interest charges and keep your credit utilization low.

- Make payments on time to maintain a positive payment history, which is a significant factor in your credit score.

- If possible, pay multiple times throughout the month to reduce your balance and improve your credit utilization ratio.

- Set up automatic payments or reminders to ensure you never miss a due date.

- Regularly monitor your credit score and report to track the impact of your payment habits and catch any errors quickly.

The Credit Score Equation: What Really Matters?

Understanding the credit score equation helps me identify the factors that truly influence my credit score. It’s a blend of payment history, credit utilization, length of credit history, types of credit, and recent credit inquiries. Focusing on these elements can make a significant difference in your score. For practical tips on how to boost your credit quickly, you can check out 9 Real Ways to Improve Your Credit Fast.

Decoding Credit Utilization: Why It’s a Game-Changer

Credit utilization refers to the ratio of your credit card balances to your credit limits, and it’s a major factor affecting your score. Keeping this ratio below 30% can signal to lenders that I’m responsible with credit. Even lower utilization can yield better results, so I always try to pay down balances before bill due dates to keep my utilization low.

Payment History: The Single Most Impactful Factor

Payment history accounts for about 35% of your credit score, making it the most significant factor. A string of on-time payments demonstrates reliability, while even one missed payment can severely impact my score. I prioritize setting up reminders or automatic payments to ensure I never miss a due date.

With payment history being such a key player in the credit score game, I’m always aware that just a single late payment can stay on my credit report for up to seven years. Plus, having a consistent record of on-time payments not only boosts my score but also establishes trust with lenders, making it easier to secure loans or credit in the future. Each time I check my statements and ensure timely payments, I’m actively increasing my chances of getting favorable rates when I need financing.

Strategies for Timely Payments: Building Your Credit Muscle

Consistently paying your credit card bills on time is like exercising your financial health; it strengthens your credit score over time. Adopting smart strategies makes it simpler to stay committed. Deliberate planning, such as tracking due dates or setting reminders, can transform your payment habits from erratic to reliable. With these methods, I can ensure that my credit score is a reflection of my responsible financial behavior.

Setting Up Automatic Payments: Making Consistency Effortless

Automatic payments can be a game changer in managing your credit card bills. By scheduling payments directly from your checking account, you eliminate the risk of missing a due date. I’ve found that this simple setup takes away the guesswork and stress. The convenience of auto-pay not only preserves my peace of mind but also builds a solid payment history, positively influencing my credit score.

The Power of Early Payments: Why Paying Ahead Matters

Paying your credit card bill before the due date can have substantial benefits. Early payments can reduce interest charges, especially if you carry a balance, and help keep your credit utilization low—the key component of your credit score. By staying proactive, I discover that I’m not just lowering my expenses, but also positioning myself more favorably in the eyes of lenders.

Consider this: If I consistently pay my bill a week or two before the due date, I not only dodge the late fees but also give myself room to breathe regarding financial planning. For instance, if I utilize the early payment strategy on a card with high interest, I may effectively cut down the amount I owe over time. Moreover, keeping my balances low relative to my available credit limits could elevate my credit score, which makes applying for loans or a mortgage much more favorable in the future.

The Importance of Staying Below Your Credit Limit

Maintaining a credit utilization ratio below 30% is vital for keeping my credit score healthy. This ratio reflects how much credit I’m using compared to my total credit limits and is a significant factor in credit scoring models like FICO. If I exceed this threshold, it can signal to lenders that I’m financially overextended, which may negatively impact my creditworthiness. Staying mindful of my spending can help ensure that I remain well below my limits, foster better credit habits, and ultimately result in a higher credit score.

Balancing Acts: Strategies for Lowering Credit Utilization

Finding effective ways to manage my credit utilization can lead to positive changes in my credit score. I can start by paying down existing balances and making multiple payments throughout the month, which keeps my reported balances lower. Additionally, requesting a credit limit increase could give me more room to maneuver while maintaining a lower utilization ratio. If necessary, consider spreading out my charges over multiple cards to avoid maxing out any single account.

The Role of Reporting Cycles: Timing Your Payments Right

The timing of my credit card payments can significantly influence my reported credit utilization. Credit card companies typically report my balance to credit bureaus at the end of the billing cycle. By paying my bill before this date, I can ensure a lower balance is reported, which positively affects my credit score. Understanding my credit card’s billing cycle allows me to strategically plan payments and optimize my credit utilization ratio.

For instance, if I know that my credit card issuer reports on the 15th of each month, I can make a payment a few days prior to that date. This way, the amount reported to the credit bureaus reflects my intent to keep my utilization low. Moreover, if I’m anticipating a large charge, making an advance payment can not only help in staying below the 30% threshold but also demonstrate responsible credit management to potential lenders. By leveraging my knowledge of reporting cycles, I have more control over how my credit health is perceived.

Monitoring Your Credit Progress: The Path to Continuous Improvement

Keeping an eye on my credit score and report helps me recognize patterns in my financial behavior and identify areas for improvement. Regularly monitoring my credit progress allows me to manage my debts effectively and stay aware of emerging opportunities to enhance my creditworthiness. I like to review my credit score monthly and track major fluctuations to understand how my actions impact my overall financial health.

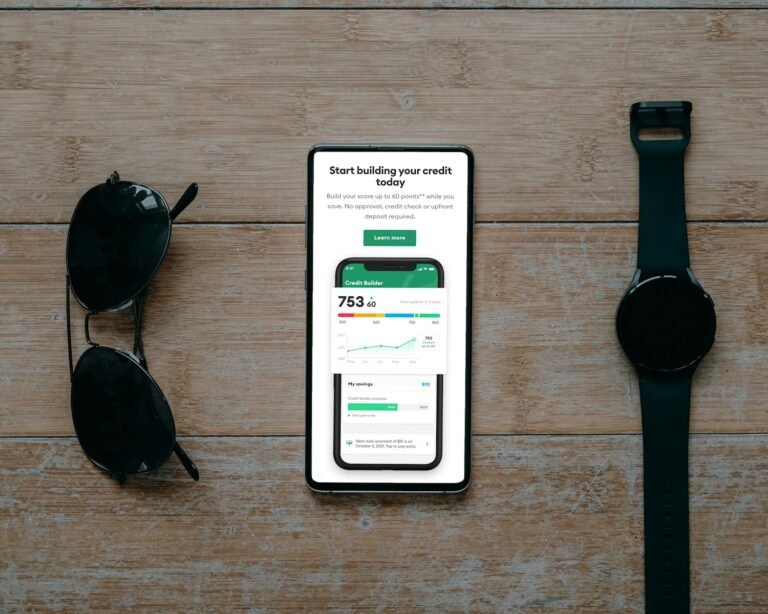

Utilizing Credit Monitoring Tools: What to Watch For

Credit monitoring tools can be an excellent resource for staying updated on my credit history. By setting up alerts for new inquiries, changes to existing accounts, or notable score changes, these tools keep me informed and empowered to take action if necessary. I’ve found having a mobile app that tracks my credit score makes it easier to stay engaged with my financial journey.

Understanding Your Credit Report: Spotting Errors and Making Corrections

My credit report is a window into my financial life, revealing everything from payment history to outstanding debts. Regularly reviewing my report helps me spot any inaccuracies that could negatively impact my score. If I find an error, such as a late payment that I know I made on time, I contact the creditor immediately to dispute it and provide any necessary documentation to rectify the situation.

Understanding my credit report means digging into the details that matter most. For instance, I’ve noticed that some discrepancies arise from outdated information, such as accounts that have already been closed or paid off but still reflect as active. To correct these errors, I reach out to the credit reporting agencies with precise documentation, including account statements and confirmation letters. After a review, most disputes are resolved in my favor, helping to enhance my credit score and ensuring my report accurately reflects my financial responsibility.

The Transformative Impact of Paying More Than the Minimum

Paying more than the minimum on your credit card not only reduces your balance faster but also significantly enhances your credit score over time. By making larger payments, you lower your overall credit utilization ratio, which is one of the key factors in calculating your credit score. This shift in payments can save you from long-term debt traps and foster a more positive credit history, enabling you to achieve financial freedom sooner.

The Interest Trap: How Minimum Payments Can Cost You

Choosing to pay only the minimum amount due each month can ensnare you in a costly cycle of debt. When I first started using credit cards, I noticed that a large portion of my payment went toward interest rather than reducing my principal balance. Over time, I realized that by only paying the minimum, I would end up owing significantly more than what I initially charged—sometimes extending the payment period for years.

The Acceleration Effect: Compound Benefits of Paying Extra

Paying extra towards your credit card bill creates a powerful acceleration effect that can lead to significant savings. For instance, if I consistently pay an additional $50 over the minimum payment each month, I can cut my repayment time and save on interest, allowing me to reach my financial goals faster. This cumulative impact becomes even more pronounced with high-interest credit cards, where your extra payments help reduce the overall debt and ultimately result in a stronger credit score. Imagine cutting a 10-year repayment down to 6 years simply by adjusting your monthly payments! Never underestimate the power of those extra dollars.

Summing up

So, paying your credit card bill on time and keeping your balances low can significantly boost your credit score. By setting up reminders or automating payments, I ensure that I never miss a due date. Plus, if I can pay more than the minimum payment, I make it a point to do so. With these simple steps, you can take control of your credit and watch your score improve over time. It feels great knowing I’m on the right track financially!

FAQ

Q: How does paying my credit card bill on time affect my credit score?

A: Paying your credit card bill on time is one of the most significant factors that influence your credit score. It reflects your payment history, which accounts for approximately 35% of your score. Consistently making timely payments demonstrates to creditors that you are responsible with your credit, potentially leading to an improved credit score over time.

Q: What is the best way to ensure I don’t miss a credit card payment?

A: To avoid missing payments, consider setting up automatic payments through your bank or the credit card issuer. This allows for automatic deducting of the minimum payment or the full balance on the due date. Additionally, you can use calendar reminders or mobile alerts to notify you a few days in advance of the due date, providing an extra layer of precaution.

Q: Should I pay my credit card bill in full or just the minimum payment?

A: Paying your credit card bill in full is generally the best option. Full payment helps avoid interest charges, keeps your credit utilization ratio low, and demonstrates to creditors that you can manage your debts effectively. Paying only the minimum can lead to accruing interest on the remaining balance, which can hurt your credit score over time.

Q: How does my credit utilization ratio play into my credit score when I pay my credit card bill?

A: Your credit utilization ratio is the percentage of your total credit limit that you are currently using. It’s recommended to keep this ratio below 30%. Regularly paying down your credit card balances can help lower your utilization ratio, which may positively impact your credit score. A lower utilization demonstrates that you are not overly reliant on credit, which is favorable for lenders.

Q: What other practices can help improve my credit score while managing my credit card payments?

A: In addition to making timely payments and maintaining a low credit utilization ratio, you can improve your credit score by regularly checking your credit report for errors and disputing any inaccuracies. Diversifying your credit mix, such as having a combination of credit cards, installment loans, and retail accounts can also support your score. Lastly, limiting new credit inquiries and keeping old accounts open can aid in building a longer credit history, which is beneficial for your score.