How To Raise Credit Score Without Credit Card

You might think that having a credit card is vital for boosting your credit score, but I’m here to share with you some effective strategies that don’t involve plastic. In this post, I will guide you through simple steps you can take to improve your credit score using alternative methods. Your credit score is important, and with the right approach, you can reach your financial goals without relying on credit cards!

Key Takeaways:

- Pay bills on time to establish a positive payment history, which is a significant factor in your credit score.

- Maintain low balances on any existing loans, as this can positively impact your credit utilization ratio.

- Consider becoming an authorized user on a responsible person’s credit card to benefit from their positive credit history.

- Regularly check your credit report for errors and dispute any inaccuracies to ensure your score reflects your true creditworthiness.

- Build a diverse credit mix by exploring installment loans or retail accounts, which can enhance your overall score.

Your Credit Report: The Secret Decoder Ring

Your credit report holds the key to understanding your financial health and boosting your credit score. Think of it as a comprehensive snapshot of your credit history, including payment records, outstanding debts, and inquiries. Each section of your report can unlock insights that help you improve your creditworthiness without relying on credit cards. Regularly checking your report gives you the opportunity to spot potential errors and take corrective measures that lead to a better score over time.

How to Obtain Your Credit Report for Free

Analyzing Your Report for Red Flags and Opportunities

Thoroughly analyzing your credit report reveals both potential red flags and opportunities for improvement. Look out for negative marks like late payments or collections that could drag down your score. At the same time, identify areas where you’re doing well, such as a long history of accounts or low credit utilization. Keeping a sharp eye on these details could lead to actionable steps to raise your score, like disputing inaccuracies or focusing on maintaining a clean payment record.

When I examined my credit report, I discovered a small discrepancy—a late payment that wasn’t mine. After disputing it with the credit bureau, my score jumped. Observing these red flags helped me prioritize what to fix, while spotting positive aspects inspired me to keep consistent with my payments and open new opportunities for credit-building. It turns out, understanding your report is less about the numbers and more about knowing how to leverage the information inside it for better financial choices.

Timely Payments: The Unsung Hero of Credit Elevation

Timely payments serve as the backbone of a healthy credit score. Each time I make a payment on time, I reinforce my creditworthiness in the eyes of lenders. In fact, payment history accounts for about 35% of the total credit score calculation. This means that regularly meeting my payment deadlines can make a significant difference in elevating my credit score without needing to rely on credit cards.

Establishing a Consistent Payment Schedule

Creating a consistent payment schedule has worked wonders for me. By listing all my bills along with their due dates, I am able to set reminders and allocate funds in advance, ensuring that I never miss a payment.

Utilizing Bill Reminders and Auto-Pay for Effortless Timeliness

Utilizing bill reminders and auto-pay has simplified my financial life immensely. With most utility and service providers offering these features, I can automate payments, reduce stress, and avoid late fees effortlessly.

Setting up auto-pay not only guarantees that my bills are paid on time, but it also helps me stay on top of my budget. I can choose to have the payment deducted from my bank account a few days before the due date, which gives me a buffer should any issues arise with my funding. Regularly checking my statements ensures there are no surprises, and handling payments this way has contributed positively to my credit profile. The end result is peace of mind and a steadily improving credit score over time.

Cultivating Credit Utilization Wisdom

Managing credit utilization wisely is pivotal in enhancing your credit score. Even without a credit card, there are creative ways to demonstrate your creditworthiness. I’ve learned that mitigating existing debts while ensuring that I’m not overleveraged showcases my financial discipline. Bear in mind, balancing debt and available credit falls directly into credit utilization, significantly impacting your score.

The 30% Rule: What It Means and Why It Matters

The 30% rule is a guideline indicating that you should aim to use no more than 30% of your available credit at any time. If you do not have credit cards, focus on maintaining low balances on any loans or lines of credit you have, as this percentage still reflects on your overall financial health. Sticking to this guideline helps me keep my credit score within an optimal range, allowing for future opportunities.

Strategies for Managing Existing Debt Without New Credit

Managing existing debt without resorting to new credit can seem challenging, but there are effective strategies. I prioritize paying down my highest interest debts first, as this saves me money in the long run. Additionally, consolidating loans can help streamline payments and potentially lower interest rates. Another approach I utilize is setting up a budget that allocates a fixed percentage of my monthly income towards debt repayment; this creates a disciplined plan that works wonders in reducing my overall debt.

Finding the right strategies for managing existing debt can significantly influence your credit utilization ratio. For instance, I set up a snowball method where I focus on paying off the smallest debts first while making minimum payments on larger ones, which not only boosts my confidence but also keeps my credit utilization in check. Additionally, negotiating with creditors for lower interest rates or payment plans can be advantageous. This proactive approach reduces financial stress and demonstrates reliability to potential lenders, fostering positive credit behavior without needing additional credit sources.

Diversifying Your Credit Profile Without Cards

Diversifying your credit profile can significantly boost your credit score, even in the absence of credit cards. A mix of different credit types demonstrates your ability to handle various forms of debt responsibly. This can include installment loans such as personal loans or auto loans, alongside credit options that don’t require a card. By embracing these alternatives, you can create a well-rounded credit history that lenders look favorably upon.

Exploring Alternative Credit Options: Loans and Lines of Credit

Alternative credit options like personal loans or lines of credit help in building your credit score without the need for a credit card. When you apply for an installment loan, your consistent repayment history contributes positively to your credit score. Moreover, some lenders even report to credit bureaus, further enhancing your credit visibility. Just ensure you choose loans with manageable interest rates to maintain a flexible financial balance.

How to Build Credit Through Rent Payments and Utility Bills

Building credit through rent payments and utility bills is a practical and effective strategy. Many landlords and utility providers now report your payment history to major credit bureaus, allowing your consistent payments to work in your favor. Services like Experian RentBureau facilitate this process by aggregating rental payment data, significantly influencing your credit score positively if you maintain timely payments.

Utilizing rent and utility payments allows you to construct a positive credit history without requiring traditional credit sources. For instance, if you’ve been paying your rent consistently for years, this payment record can be just as impactful as a credit card. Taking advantage of services that report these payments enables you to enhance your credit score by simply managing your monthly bills. Staying punctual with these obligations demonstrates reliability to future lenders, potentially opening doors to better loan terms and interest rates down the line. By including this strategy in your credit-building toolkit, you lay a solid foundation for future financial success.

Building Trust with Creditors: The Power of Communication

Open lines of communication with creditors can markedly enhance your credit profile. Effectively sharing your financial situation or any difficulties faced fosters a sense of trust. By proactively reaching out to inform them of potential late payments or other concerns, you may unlock flexible options or grace periods, ultimately reflecting positively on your credit report. Transparent dialogues can lead to understanding, and even potential adjustments that help maintain your creditworthiness.

Proactive Dispute Strategies for Inaccurate Entries

Addressing inaccuracies on your credit report demands quick action and strategic communication. Initiating a dispute with credit bureaus should become a routine check-up in your financial health regimen. I’ve found that documenting evidence methodically, like payment confirmations and correspondence with creditors, strengthens your case. The faster you present your dispute, the more likely errors will be resolved promptly, thus protecting your credit score.

Establishing Relationships with Lenders for Better Terms

Building rapport with lenders can significantly impact your future borrowing experiences. Regular communication and demonstrating reliability can open doors to improved lending terms, lower interest rates, and even increased borrowing limits. A personal touch, such as sharing your financial goals and progress, helps lenders see you as a valuable customer rather than just another number. When I proactively engaged with my lenders, I was often surprised at how ready they were to answer questions or offer assistance tailored to my needs.

When you take the time to cultivate a relationship with lenders, it transforms the dynamic from business to partnership. Opening discussions about your financial plans can lead to tailored solutions, such as flexible repayment options or even special loan products that fit your needs. My own experiences revealed that simply being approachable and sincere in my intentions made lenders more accommodating. By showing consistent responsibility and honesty, I not only gained their trust but often found myself in a better position when seeking loans or refinances.

To wrap up

Following this guide, I’ve learned that raising my credit score without a credit card is possible through simple yet effective strategies. I can build positive credit history by paying bills on time, reducing existing debt, and regularly checking my credit report for errors. Each step I take contributes to a healthier financial future, so I encourage you to embrace these methods. With patience and consistency, you can watch your credit score improve, leading to better financial opportunities down the road!

FAQ

Q: Can I improve my credit score without using credit cards?

A: Yes, you can improve your credit score without credit cards by focusing on other aspects of your credit history. For example, consistently paying your bills on time, such as utilities and rent, can positively influence your credit score. Additionally, having a secured loan or an installment loan that you repay on time can also help build your credit profile.

Q: How does my credit utilization affect my credit score?

A: Credit utilization refers to the amount of credit you are using compared to your total credit limit. Although this is primarily related to credit cards, if you don’t have any credit cards, your credit utilization won’t apply. However, maintaining a low debt-to-income ratio and managing any existing loans responsibly can help keep your credit profile healthy.

Q: Does being an authorized user on someone else’s credit card help my credit score?

A: Yes, being added as an authorized user on a responsible person’s credit card can positively impact your credit score. As an authorized user, the account’s history will be included in your credit report, provided the primary cardholder maintains a good payment history and low credit utilization. This can help you build credit without needing your own credit card.

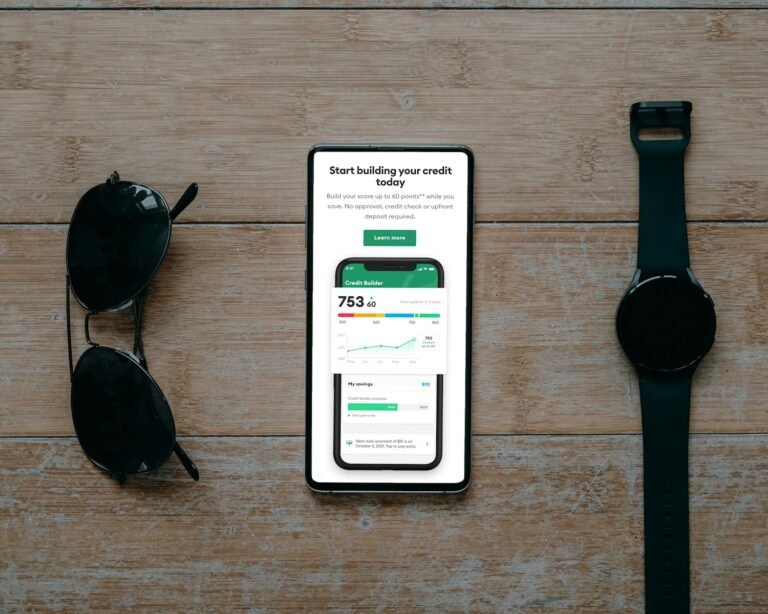

Q: How can I build credit history if I don’t have credit cards?

A: You can build credit history through various types of credit accounts. Consider applying for a secured loan, which involves depositing an amount as collateral, or a credit-builder loan, which is designed specifically for establishing credit. Timely payments on these accounts contribute positively to your credit history and score.

Q: What role does checking my credit report play in raising my credit score?

A: Regularly checking your credit report is important for maintaining a healthy credit score. By reviewing your report, you can identify any inaccuracies or fraudulent activities that might negatively affect your score. Disputing errors and ensuring all information is accurate is vital for improving and sustaining your credit score over time.