How to Avoid Common Debt Traps

Managing your finances effectively is vital to navigating the complexities of debt. In this post, I will share practical tips and strategies to help you steer clear of common debt traps that many individuals encounter. By understanding the pitfalls and adopting smart budgeting practices, you can protect your financial future and gain control over your spending habits. Let’s explore how to empower yourself and make informed choices for a debt-free life.

Key Takeaways:

- Prioritize creating and sticking to a budget to manage monthly expenses and avoid overspending.

- Build an emergency fund to cover unforeseen expenses, reducing the need to rely on credit.

- Understand the terms of any loan or credit agreement before committing, paying close attention to interest rates and fees.

- Limit the use of credit cards to avoid accumulating high-interest debt, and pay off balances in full each month.

- Seek financial advice when considering significant purchases or investments to ensure informed decision-making.

Exposing the Myths of Quick-Fix Debt Solutions

The Reality of Payday Loans

Payday loans are often marketed as a quick solution to cash shortages, but they come with steep consequences. I’ve seen individuals jump into these loans, thinking they’ll get out of a tight spot, only to find themselves in a vicious cycle of debt. The average annual percentage rate (APR) on payday loans can reach an astounding 400%, far exceeding what traditional loans would offer. For many, the inability to pay off the original loan by the due date leads to rolling over the balance, further accruing even more interest. This can create a financial nightmare, where the debt expands rather than shrinks.

While payday lenders tout instant approval and minimal qualifications, they often trap borrowers in a continuous cycle of debt without assisting them in building a sustainable financial plan. As a result, many find themselves effectively working only to pay off previous loans rather than advancing financially. I recommend seeking alternatives like personal loans from reputable lenders or credit unions, which may offer much lower interest rates and better repayment terms.

Credit Card Debt: The Illusion of Minimum Payments

Many consumers are lulled into a false sense of security by the option to make minimum payments on their credit cards. This approach can seem manageable month-to-month, but the long-term consequences are far from benign. I’ve witnessed individuals who, believing they are effectively managing their finances, find that making just the minimum payment can result in years of debt. For example, if you have a $5,000 balance on a credit card with a 20% APR and only pay the minimum of $100 each month, it could take over five years to pay off that balance, costing you around $2,000 in interest alone. The longer you carry that balance, the more interest accumulates, creating a snowball effect that feels almost impossible to escape.

I’ve also found that relying on minimum payments often leads to a sense of complacency, neglecting the opportunity to pay down the principal more aggressively. Many cardholders fail to realize that any extra amount paid above the minimum can significantly reduce both the interest accrued and the payment period. Prioritizing higher payments when possible, or shifting to a card with a lower interest rate, can make a world of difference in how swiftly you can gain control over your credit card debt.

Recognizing Emotional Triggers that Lead to Debt

The Psychology of Impulse Buying

Impulse buying often stems from emotional desires rather than genuine needs. In moments of stress, boredom, or even happiness, I find myself gravitating toward retail therapy as a quick fix. A study by the Journal of Consumer Research showed that 57% of participants felt an immediate sense of joy while shopping impulsively, only to experience regret afterward. It’s this dopamine rush that can lead to unnecessary purchases, and understanding this cycle can empower you to resist it. By tracking my spending habits, I notice patterns that correspond with my emotional state, which has helped me to pause and assess whether my urge to buy is driven by actual need or emotional comfort.

Social Pressures and Their Impact on Spending

We live in a world where social norms often dictate our spending habits. This could be fueled by social media, where influencers showcase a lifestyle filled with luxury goods, vacations, and entertainment. FOMO (fear of missing out) can considerably impact your wallet and lead to debt, especially if you’re trying to keep up with friends, family, or colleagues who seem to have it all. I’ve observed my own tendencies to overspend during social outings or while scrolling through curated content online, where it’s easy to feel inadequate compared to others. A survey indicated that 43% of millennials felt pressured to spend more by their friends, and acknowledging this can assist you in making more mindful decisions.

Being aware of these social influences is half the battle. It’s necessary to create your own yardstick for financial success, independent of societal pressures. Consider setting specific personal finance goals and developing a spending plan that prioritizes your needs and values. By aligning your financial decisions with your personal objectives rather than external validation, you can resist the pull of social pressures that too often lead to unexpected debt.

Mastering the Art of Budgeting

Creating a Sustainable Spending Plan

A sustainable spending plan begins with a realistic assessment of your financial situation. I recommend tracking all income sources and categorizing your expenses into fixed and variable categories. Fixed costs include rent or mortgage, utilities, and insurance, while variable costs cover groceries, entertainment, and discretionary spending. Once I have a clear picture of my monthly cash flow, I allocate a specific percentage to savings and debt repayment based on my goals. Utilizing budgeting tools or apps can streamline this process, allowing for easier adjustments as priorities change or unexpected expenses arise.

The 50/30/20 rule serves as a useful guideline for shaping my spending plan. This means that 50% of your income should cover needs, 30% should be for wants, and 20% for savings or debt. This structure not only assists in maintaining a balanced approach but also helps in distinguishing what is important from what is simply desirable. Regularly monitoring my budget against my actual spending helps me stay on track and make timely adjustments whenever necessary.

Identifying and Reducing Unnecessary Expenses

To effectively manage your budget, identifying and cutting unnecessary expenses can lead to significant savings. Begin by examining your subscriptions—services such as streaming platforms or gym memberships can often go unused. If you find that you haven’t touched a particular service in months, it might be time to cancel. Furthermore, I evaluate my grocery shopping habits by creating a list before heading to the store, which helps in avoiding impulse purchases that can quickly add up. Additionally, utilizing coupons or taking advantage of sales can make a noticeable difference in monthly expenses.

Another practical approach is to assess your dining-out habits. Regularly splurging on takeout meals can drain your finances without you even noticing. Cooking at home not only saves money but also allows for healthier eating. I’ve found that meal prepping for the week minimizes both grocery shopping trips and the temptation to order in. Reducing unnecessary expenses relies on being mindful and intentional in each spending decision.

Building a Safety Net: The Importance of Emergency Savings

A robust emergency savings fund acts as a financial buffer that can help you avoid the perilous pitfalls of debt. Life has its unexpected twists, and an emergency fund provides you with the means to handle those situations without resorting to high-interest loans or credit cards. According to financial experts, having at least three to six months’ worth of living expenses in a dedicated fund helps safeguard against sudden medical bills, job loss, or major car repairs. I’ve found that this safety net offers peace of mind, allowing me to focus on long-term financial goals instead of worrying about immediate financial setbacks.

Establishing a Contingency Fund

An effective way to start building your emergency savings is to establish a contingency fund, which specifically aims to cover unexpected expenses. Begin by determining what constitutes an emergency for you. This might include urgent home repairs, unexpected medical expenses, or urgent travel needs. Establishing a clear purpose for your fund helps in maintaining discipline when it comes to saving. Set up a separate savings account to keep your emergency funds accessible but separate from your everyday finances. This distance acts as a psychological barrier, discouraging impulsive withdrawals.

Set a target amount that aligns with your unique circumstances. I found it helpful to evaluate my monthly expenses and create a realistic target based on those calculations. For instance, if my monthly expenses total around $3,000, aiming for a minimum of $9,000 would provide me with a solid cushion in times of need. As I contribute to this fund, even small, consistent deposits can accumulate quickly, turning what may seem like a daunting goal into a more manageable reality.

Setting Realistic Savings Goals

When considering savings, setting realistic goals is not just about achieving numbers; it’s about creating a sustainable habit that you can maintain over time. Start small if necessary, perhaps targeting an initial goal of $500 or $1,000, and build from there. Breaking your larger goal into smaller, manageable milestones makes it easier to measure progress and stay motivated. For example, if your ultimate goal is to reach $5,000 in two years, aiming to save approximately $200 a month can make the overall target feel less overwhelming.

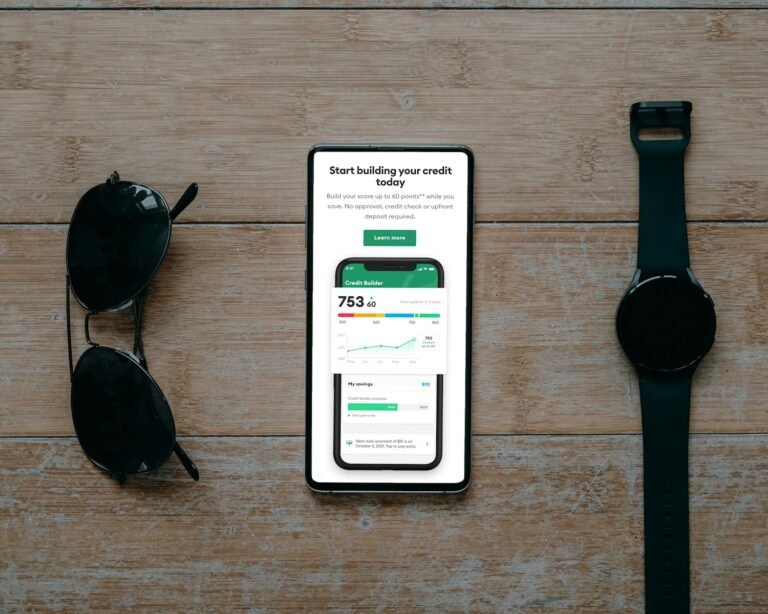

One useful strategy is to align your savings goals with your pay schedule, automatically directing a portion of your income each month into your emergency fund. Establishing these automated deposits ensures the money is saved before you have the chance to spend it elsewhere. Additionally, tracking your progress with mobile apps or spreadsheets can lend visual reinforcement to your journey, showcasing just how achievable your goals truly are. Having a clear path and seeing that path unfold can keep you focused and dedicated, driving home the reality that those savings can save you from falling into a debt trap down the line.

Long-Term Strategies for Financial Resilience

Investing in Financial Literacy

Gaining a solid understanding of financial concepts significantly empowers you to make informed decisions about your money. Engaging with resources such as books, online courses, and workshops can deepen your knowledge and expand your financial skill set. For instance, familiarizing yourself with concepts like compounding interest, risk assessment, and investment diversification enables you to navigate your financial landscape more effectively. Many public libraries even offer free access to financial literature and community programs, making it easier to foster a learning habit without breaking the bank.

Taking the time to engage in discussions with financial professionals or joining community forums can also provide valuable insights. Connecting with like-minded individuals who are on similar financial journeys can lead to shared strategies or new perspectives that may not have occurred to you before. When I started participating in a local finance group, I not only enhanced my knowledge but also cultivated accountability and support among peers striving for financial success.

Navigating Credit Wisely for Future Needs

Strategically using credit can help you build a solid financial foundation if managed well. Understanding your credit score, the factors that affect it, and how to improve it can create future opportunities, such as lower interest rates on loans and improved chances of getting approved for mortgages. Regularly checking your credit report helps you keep an eye on inaccuracies that could derail your financial progress. For instance, I often recommend scheduling a time every year to review your report from the three major credit bureaus. This proactive approach keeps you informed and prepared to tackle any discrepancies that might arise.

Leveraging credit cards for specific purchases can also lead to rewards or cashback if used responsibly. However, it’s key to always stay within your budget, making sure to pay off the full balance each month to avoid interest fees that can accumulate quickly. Additionally, exploring options like secured credit cards can help if you’re working to establish or rebuild your credit history without falling into a debt pit.

Conclusion

Upon reflecting on the various strategies for avoiding common debt traps, I realize that being proactive in managing my finances is crucial. By setting a realistic budget, prioritizing needs over wants, and keeping track of my spending habits, I can reduce the likelihood of falling into unnecessary debt. I have learned the importance of distinguishing between good and bad debt and understanding the terms of any credit I choose to utilize. Making informed decisions about loans and credit cards can significantly improve my financial health and provide peace of mind.

Moreover, it’s vital for me to continually educate myself about personal finance and seek guidance if needed. Whether it’s through reading financial books, attending workshops, or speaking with a financial advisor, there are endless resources available to help me stay on track. Ultimately, avoiding common debt traps requires a blend of discipline, knowledge, and proactive engagement with my financial situation, ensuring that I can achieve my long-term goals without the burden of overwhelming debt.

FAQ

Q: What are common debt traps I should be aware of?

A: Common debt traps include high-interest credit cards, payday loans, auto loans with unfavorable terms, and overspending on unnecessary items. Understanding these can help you avoid situations where the debt quickly accumulates beyond your ability to pay it off.

Q: How can I effectively manage my credit card usage to avoid debt traps?

A: To manage credit card usage effectively, set a budget that includes only crucial expenses, limit the number of credit cards you own, and aim to pay the full balance each month to avoid interest charges. Additionally, consider using debit or cash for routine purchases to keep spending in check.

Q: What steps can I take to avoid payday loans?

A: To steer clear of payday loans, build an emergency fund that can cover unexpected expenses, explore alternatives such as borrowing from friends or family, or look into local charities that may offer assistance. Additionally, consider credit unions or community banks that might provide small personal loans at lower interest rates.

Q: Is it advisable to consolidate debt, and what should I be cautious about?

A: Debt consolidation can be beneficial as it combines multiple debts into a single monthly payment, often at a lower interest rate. However, be cautious about the terms you’re agreeing to; ensure that the consolidation loan has no hidden fees and straightforward repayment conditions. Assess whether you’ll be able to maintain responsible spending habits afterward to prevent accumulating more debt.

Q: What financial habits can help prevent falling into debt traps?

A: Establishing good financial habits includes creating and sticking to a budget, tracking all expenses, saving for emergencies, and being mindful of spending habits. It’s also beneficial to educate yourself on financial literacy topics to make informed decisions and avoid impulsive financial choices that could lead to debt.