How to Negotiate Lower Interest Rates on Loans

Most people don’t realize that negotiating lower interest rates on loans is possible, and it can save you a significant amount of money over time. In this guide, I’ll share effective strategies that you can apply to effectively communicate with lenders and secure better terms for your loans. Whether you’re dealing with credit cards, personal loans, or mortgages, I’ll help you navigate the negotiation process with confidence, ensuring that you make the most out of your financial agreements. Let’s get started on making your loans more manageable!

Key Takeaways:

- Research current interest rates and gather offers from multiple lenders to strengthen your negotiating position.

- Review your credit report and improve your credit score if necessary, as a higher score can lead to better rates.

- Be prepared to present your financial situation and demonstrate your reliability as a borrower.

- Consider negotiating with your current lender, as they may be willing to lower your rates to retain you as a customer.

- Ask about discounts or loyalty programs that could further reduce your interest rates.

Assessing Your Financial Profile

Understanding your financial profile is vital before exploring into negotiations for lower interest rates on loans. This involves a thorough evaluation of various factors, particularly your credit score and existing loan terms. The better your financial health portrayed through these metrics, the stronger your position becomes when discussing potential interest rate reductions with lenders. Knowing where you stand can empower you to present compelling arguments while advocating for more favorable terms.

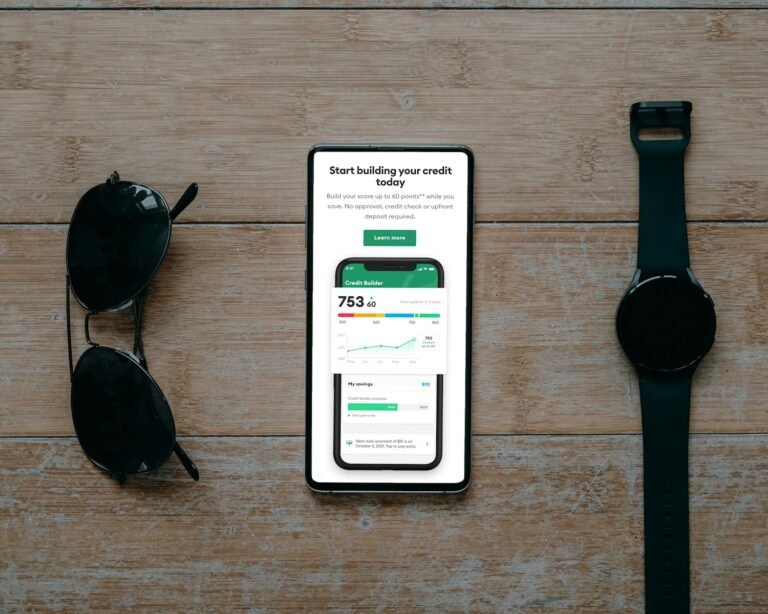

Evaluating Your Credit Score

Your credit score acts as a financial report card, summarizing your credit history and helping lenders gauge the risk of lending to you. A score above 700 typically qualifies as good, while anything above 750 places you in an excellent category. This not only positions you to negotiate better rates but also reassures lenders of your reliability. If your score is below these thresholds, I recommend focusing on improving it before bringing your interest rate negotiations to the table. Pay down existing debts, make on-time payments, and check for errors on your credit reports that could be dragging your score down.

Have a close look at the components affecting your score. Credit utilization, for example, refers to how much of your available credit you’re using. A ratio below 30% is ideal. If you’re currently relying heavily on credit cards, consider paying them down first to improve your score. Additionally, older accounts contribute positively to your score. If you have old credit lines that you’re tempted to close, think twice because they can enhance your average account age, which can be favorable during negotiations.

Analyzing Current Loan Terms

A detailed review of your current loan terms provides insights not just about your repayment journey, but also opens doors for negotiation opportunities. This includes understanding your interest rate, monthly payment amounts, and the total cost over the life of the loan. Gather all documentation related to the loans, including the original agreement, any amendments, and your payment history. By doing so, you position yourself to evaluate how much of a financial burden your current rates are imposing.

For instance, if you originally signed up for a loan at an interest rate of 6% and market rates have dropped to around 3%, there’s a valid reason to approach your lender for a lower rate. Having this data on hand not only aids in solidifying your case but also reflects your proactive approach in managing your finances. This comprehensive analysis helps you paint a clearer picture of your overall financial obligations, which could be pivotal in negotiating terms that allow for greater savings.

Preparing for the Negotiation

Effective preparation sets the stage for successful negotiations with lenders. I recommend starting by gathering relevant documentation that illustrates your current financial situation, such as your credit report, income statements, and payment history. Having this information readily available demonstrates to the lender that you are serious and informed about your financial standing. In addition, building a comprehensive understanding of current market trends can give you the confidence to negotiate more effectively. By knowing where interest rates stand presently, you can assertively advocate for a better rate in line with what you see offered by competitors.

Gathering Competitive Offers

To strengthen your position, I found that collecting competitive offers from various lenders can be invaluable. Reach out to at least three to five different financial institutions and obtain quotes based on comparable terms for the loans you seek. This allows you to create a clear picture of the current landscape and enables you to identify not just the best offer, but also those that could serve as leverage in your negotiations. Make sure to include both traditional banks and non-traditional lenders, as the latter often provide enticing rates that might surprise you.

During the negotiation process, I often refer back to these competitive offers when speaking with my lender. Demonstrating that I have options shows that I am informed and prepared, which may incentivize the lender to work with me to keep my business. It’s beneficial to have this printed documentation on hand to discuss specifics—this shows that you are not just negotiating on feelings, but on tangible offers that can effectively influence the outcome.

Understanding Lender Motivations

Getting to grips with what motivates lenders can help frame your negotiation strategy. Lenders are primarily driven by the desire to maintain a competitive edge in the market while maximizing profit. This can vary widely—some lenders may prioritize customer retention or seek to meet sales quotas. Knowing this allows you to tailor your discussion points to align with their motivations. For instance, if a lender is trying to grow their loan portfolio, they may be more receptive to a rate reduction in hopes of securing you as a long-term client.

When considering this aspect, it’s vital to think about timing and the lender’s broader objectives. If you know the lender is facing increased competition or they’ve just reduced their rates, I leverage that information during the negotiation. I also pay attention to their customer service philosophy; lenders who value customer satisfaction might be more willing to negotiate. By framing my request within the context of their business interests and demonstrating my value as a customer, I enhance the chances of not only receiving a lower interest rate but also establishing a beneficial long-term relationship with the lender.

Effective Communication Strategies

Crafting Your Negotiation Script

The key to a successful negotiation often lies in having a well-defined script that outlines your main points. I usually start with a brief introduction that expresses gratitude for the lender’s time, then quickly transition into my reasons for seeking a rate reduction. Presenting a clear, concise argument that includes the specifics of my financial profile—such as my payment history and credit score—creates a solid foundation for my case. For instance, if you can show a history of consistent payments over the past year along with a credit score improvement, mentioning these facts serves to strengthen your position significantly.

In your script, I recommend including a few comparative figures if you have them. For instance, saying, “I’ve recently received offers from other lenders for rates that are about 1% lower than what I currently have,” provides a tangible benchmark for your lender to consider. This not only demonstrates that you’ve done your homework but also encourages them to act competitively in retaining you as a customer. The combination of your strong financial standing and market awareness can be quite persuasive.

Active Listening Techniques

Effective communication isn’t just about what you say; it’s also about how you engage with the other party. I make it a point to practice active listening throughout my negotiations. This means giving my full attention to the lender’s responses and showing that I’m genuinely invested in the conversation. By acknowledging important points they raise—sometimes with a nod or a follow-up question—I’m able to foster a collaborative atmosphere that encourages negotiation over confrontation. When I sincerely seek to understand their perspective, I find that it leads to more constructive outcomes.

Active listening techniques extend beyond verbal acknowledgments. Paraphrasing what the lender has said not only clarifies any misunderstandings but also demonstrates my engagement. For example, if they mention that “the current interest rates are tied to your overall risk profile,” I might respond with, “So you’re suggesting that my credit improvements could impact my interest rate in the future?” This kind of interaction shows I’m tuned into the nuances of the dialogue and encourages further discussion about potential alternatives.

The benefits of practicing active listening can’t be overstated. It creates a sense of partnership during negotiations; each side feels respected and valued, making it easier to explore mutually beneficial solutions. The energy in the room becomes less adversarial, allowing for a more open exchange of ideas and potentially leading you to exciting offers that you might not have considered otherwise.

Leveraging Timing and Market Conditions

Identifying Optimal Negotiation Periods

To maximize your chances of securing a lower interest rate on your loans, I focus on identifying the right moments to initiate negotiations. Typically, these prime periods occur when interest rates are trending downwards due to shifts in economic policy or inflation rates. For instance, after the Federal Reserve signals a potential rate cut, I make it a point to reach out to lenders to discuss my options. This proactive approach takes advantage of the environment rather than waiting until a need arises.

Additionally, many lenders have promotional periods or seasonal offers designed to attract new customers. By doing my research and keeping track of these cycles, I can better position myself when it’s most advantageous to negotiate. I find it helpful to remain informed about current market conditions through reliable financial news sources, such as How to Get a Lower Interest Rate as Personal Loan Balances Rise, to pinpoint windows of opportunity.

Capitalizing on Economic Fluctuations

The economic landscape is constantly changing, and each shift can impact my negotiating power significantly. For instance, during a recession, as lenders become more selective, I notice they might be more willing to compromise on interest rates to retain existing customers. Thus, I keep a close eye on economic indicators, such as unemployment rates and consumer confidence indexes, before I consider asking for a lower rate.

Moreover, if I notice that inflation is stabilizing or declining, it often leads to lenders adjusting their rates accordingly. By timing my negotiations to align with these fluctuations, I can present a strong case for why lowering my interest rate benefits both me and my lender — ultimately creating a win-win scenario. Having a solid understanding of economic cycles can turn a potentially daunting process into a strategic opportunity.

Capitalizing on economic fluctuations requires both awareness and a proactive attitude. The more informed I stay about these changes, the better I can anticipate when to start my negotiations. Engaging lenders when they are under pressure or seeing shifts in the market makes my case stronger. This strategic approach not only positions me favorably in negotiations but can also yield substantial savings over the life of my loans.

Conclusion

From above, it is clear that negotiating lower interest rates on loans requires a proactive approach and a solid understanding of your financial situation. By preparing the necessary documentation, researching market trends, and emphasizing your creditworthiness, I can effectively communicate my position to the lender. It’s vital to present a compelling case that highlights my reliability as a borrower and the value of reducing the interest rates on my loans. Additionally, being open to alternative repayment options or consolidating existing loans can also contribute to more favorable terms.

Ultimately, the power lies in my ability to advocate for myself and seek better financial outcomes. You should not hesitate to engage in discussions with your lenders and explore various options available to you. By approaching the negotiation process with confidence and preparation, I can successfully lower my interest rates, which in turn can lead to significant savings over the life of the loan. You have the ability to change the financial landscape of your loans, so make sure to take action and negotiate in a way that benefits you the most.

FAQ

Q: How can I prepare for negotiating lower interest rates on my loans?

A: Preparing for a negotiation starts with gathering all relevant financial information. Review your credit score, outstanding balances, and payment history. Research current interest rates offered by other lenders to establish a benchmark. Also, have a clear understanding of your current loan terms and the reasons you’re seeking a lower rate.

Q: What information should I present to my lender during the negotiation process?

A: When negotiating, present your credit score, any recent improvements in your financial situation, and your history of timely payments. Highlight competing offers from other lenders as leverage. Be clear about why you believe a lower rate is justified based on your financial profile and market conditions.

Q: What factors can influence my lender’s decision to lower my interest rate?

A: Several factors can impact your lender’s decision, including your credit history, debt-to-income ratio, loyalty as a customer, and overall market conditions. If you can demonstrate consistent payment behavior and a solid income, your chances of a favorable outcome increase. Additionally, if you’ve improved your credit score or if general interest rates have declined, these can also help your case.

Q: What should I do if my lender refuses to lower my interest rate?

A: If your lender refuses your request, consider asking for the specific reasons behind their decision. Use this feedback to improve your situation, and don’t hesitate to explore other options. You might consider refinancing with another lender who offers a better rate or alternative loan terms that suit your needs.

Q: How often should I consider negotiating my loan interest rates?

A: It’s wise to review your loan terms and interest rates at least once a year. Keep an eye on changes in your credit score, market interest rates, and your financial situation. If rates drop significantly or your financial standing improves, it may be an ideal time to negotiate for a better interest rate.